As a market research company focused on exhibits and events, EVOLIO Marketing conducts hundreds of surveys a year for various clients, industries, exhibitors, show organizers, corporate events, and more, enabling the company to create benchmarks. “The benchmarks are comprised of a combination of post-event and on-site surveys among mainly medium and large B2B trade shows — 21,269 completed surveys,” Joe Federbush, EVOLIO Marketing’s president and chief strategist, told Convene. “What we’re looking to do is continue building upon this year after year, using it for the greater good of the industry to help exhibitors understand not only where they’re at, but what should they be striving for?”

Joe Federbush

Insights from EVOLIO’s data were presented at Lippman Connects Exhibit Sales Roundtable in Arlington, Virginia, on Feb. 29, in a session Federbush co-presented with Jon Wolff, global events manager, sales and services group, Lenovo, for around 30 participants.

Federbush shared with Convene some of those highlights.

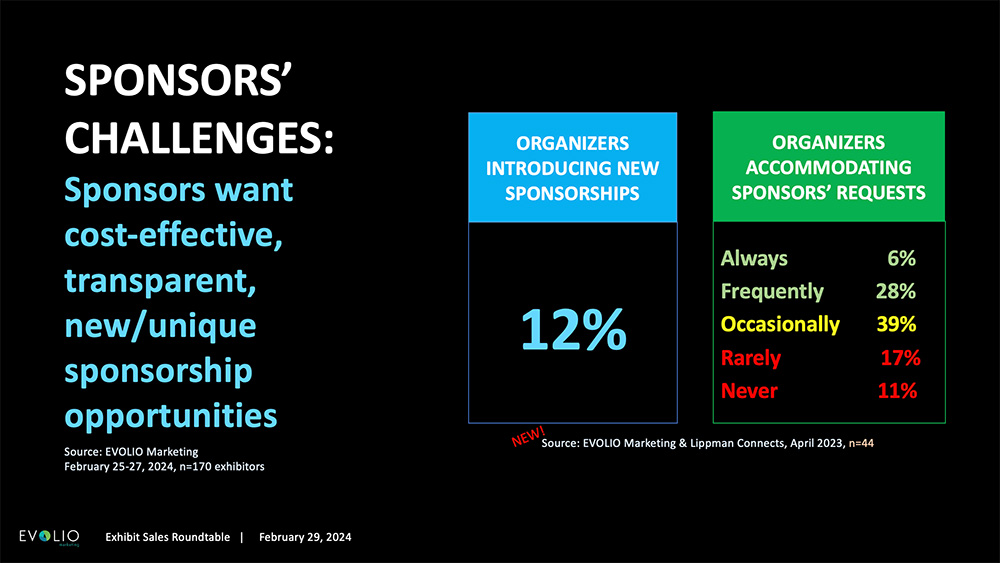

Sponsors want cost-effective, transparent, new/unique sponsorship opportunities. What they mean by transparency, Federbush said, is “Are there hidden costs?” He gave the example of a client EVOLIO is working with who invested a lot of money in a high-profile event sponsorship. As the client got closer to the attendee appreciation networking event they were sponsoring, they found out the cost of the venue was not included in their sponsorship amount, nor was catering. “It wound up being like 40 percent more than they had budgeted,” Federbush said. “So that’s a really big piece of the transparency. Another big piece of transparency is numbers of real attendees, maybe even your target audience.”

Organizers often provide total registration, he said, but it’s unclear if that total includes — or excludes — exhibitors. “We see on average, anecdotally, about 30 percent of some of the numbers are the exhibit staff, the speakers, the press, students — maybe like all these attendees who really aren’t necessarily the buyers,” he said.

Regarding new or unique sponsorship opportunities, Federbush said, companies are looking for thought leadership, which is not necessarily new, but he thinks there’s a desire for an enhanced version of what has already existed. “This pay-to-play speaking model is very important to many exhibitors vs., ‘Hey, let’s throw my logo up on every banner and my graphic everywhere.’ That’s not great from a branding objective,” he said. “When the sponsor’s objective is around thought leadership, which many are, then it’s like, ‘Alright, we don’t want to just have a session. We want to have like a great session with a great speaker where people are going to walk away with their minds blown.’” That requires close collaboration between the sponsor and the organizer, he said.

Post-COVID trade show realities. EVOLIO’s data shows that pre- to post-pandemic staff interaction rates are down — “the quality of engagement with booth staff is down now,” Federbush said. “It’s not that it’s a train wreck. It’s not like it went from like 85 percent to 40 percent. But it did go down a few percentage points, and as people who go to trade shows, we see it, we’ve witnessed it.” He chalks this up to a lack of training for newcomers to the trade-show industry, but he also cites a “sense of complacency from work from home from when we were doing digital and virtual. And now it’s like, ‘Oh, cool, I get to go to a trade show. But I got to stand all day on my feet and work a booth.’ I know that was an issue before — we’re not going to say it never was. It just feels like it’s more of an issue now.”

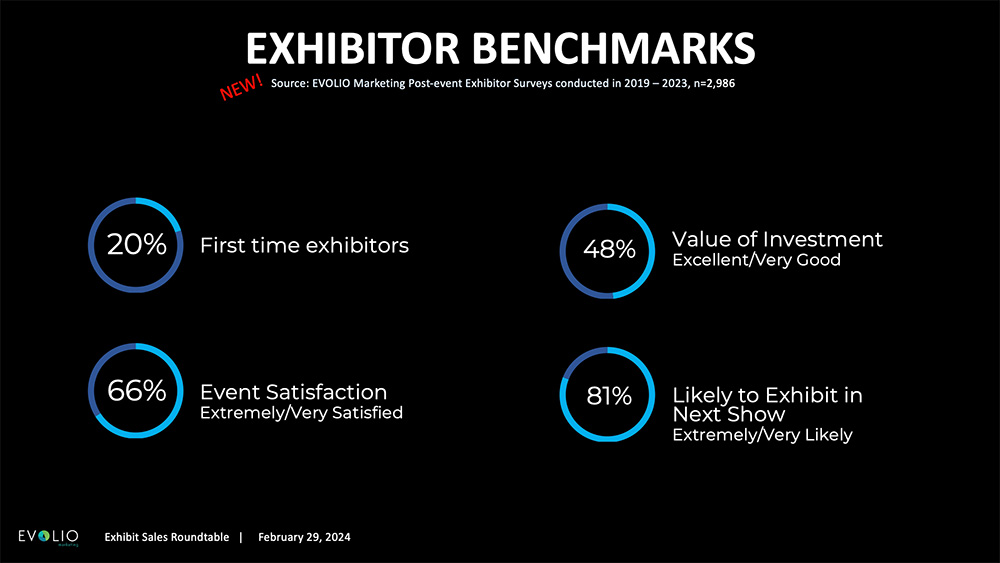

Looking at the ROI from a fresh perspective. Less than half of exhibitors rate the value of their investment as excellent or very good, but Federbush sees that in a glass half-full kind of way. One out of two exhibitors, he said, “isn’t necessarily horrible. I mean, yes, you would hope it would be better because you’re thinking about ROI like your 401K, but it’s a very hard thing to measure. Return on investment could mean a lot of different things. What’s not being shown here is that it’s like really an extra 30 percent that are rating the value of investment as good, which is a little more neutral, right? But we don’t look at good as being good enough, though.”

Part of what’s tipping the value equation downward is the rising costs to exhibit — “I’ve seen anywhere from 29 to 32 percent higher compared to pre-COVID,” Federbush said. “It’s harder to prove the value of your investment if the costs outpaced the quality of leads, the quality of attendees, the potential revenue opportunities, and demand gen? But they’re still satisfied with the event — meaning, ‘Well, what if we weren’t here?’ Because that’s the other way of looking at the value of the investment as well as satisfaction. ‘What if we’re not here? We don’t get to put our brand out there. We don’t get these new opportunities. We don’t get to connect with our customers. We don’t get to generate new leads and see prospects.’”

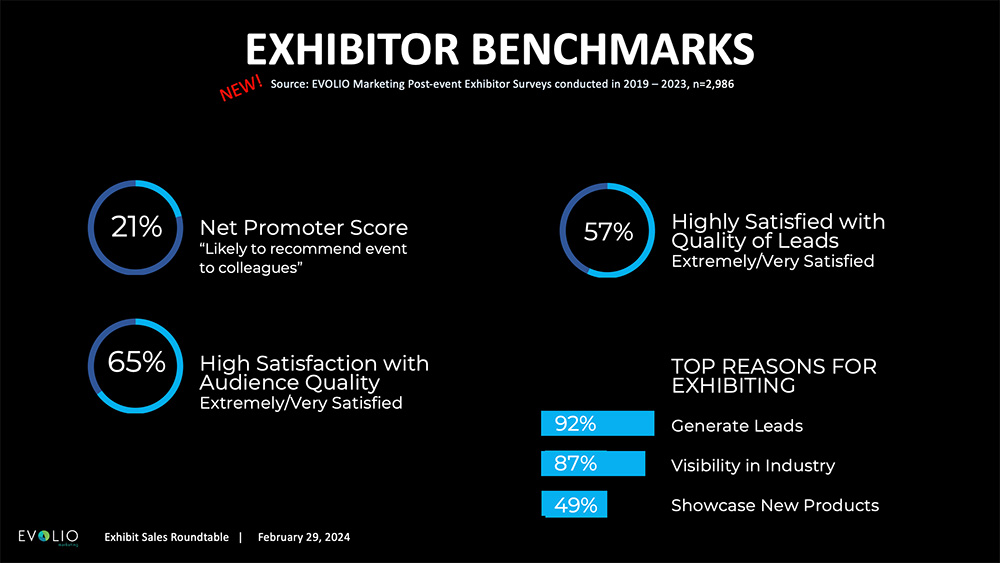

Net Promoter Scores (NPS) are low — why? Twenty-one percent is “pretty low,” Federbush conceded. But, he added, the NPS for exhibitors has been around that level consistently for around 15-20 years. “What’s interesting is the attendee Net Promoter Score tends to be around 40,” he said, “because they can talk the show up to their colleagues at work and their peers and say they learned all this great stuff. And that’s why it’s so much higher because the question — How likely would you be to recommend this event to your colleagues? — is just more relevant from that attendee perspective.”

That’s a less relevant question for other roles. “If you’re in sales, for example, you’re going to have a different lens on recommending an event to your colleagues,” he said, “because you’re going to talk to your other salespeople, who may say, ‘There aren’t enough prospects here, I didn’t see a lot of customers.’ But if you’re in marketing, you’d be like, ‘Oh my god, this is the best brand opportunity for us.’ If you’re an executive who has buy-in for event marketing, they’re going to say, ‘I got to speak at a general session or keynote. It was great.’ Or if you’re an executive, you may say, ‘Wow, the cost of exhibiting is so high, why are we doing it?’ Then of course, you’re going to be less likely to recommend it to colleagues, so it’s a very volatile metric from that internal exhibitor point of view.

“And which to me, makes sense that when you segment the data, you’re looking at salespeople vs. marketing people vs. executives. That’s where the scores really do vary quite a bit. ROI is just this very nebulous, very-difficult-to-track metric. What we’re seeing more is ROX and ROE — return on experience and return on emotion — which ties in with the sentiment towards an event.”

Federbush said experience and emotion considerations are more important than going straight to the ROI, because then “you don’t reverse-engineer the process to understand the visitor/attendee as well as the exhibitor journey. The ROI is the end result. What’s the journey to get there? And the journey to get there is the experience and the emotion that’s delivered pre-, during, and post-event. So when you think about emotion, which is sentiment, do you feel that this event was a good use of your time and money? Would you — beyond that promoter score — be likely to recommend it? What would you say if you were to recommend it? What did you like most about it? What was mind blowing? What were some of the most important takeaways, what’s something you can implement in your job tomorrow? Those are what’s important, because if those all have poor answers, your ROI is in the garbage. Those are feedback questions for exhibitors — and for attendees, absolutely. You’ve got to get to what we call ‘VoV’ — voice of the visitor. The point is to get inside their head, give them a chance to share their feelings about the event, because the cost of exhibiting, the cost of travel, the cost of attending, the cost of being away from the office and your family — it’s a pretty aggressive ask to get people to take three to five days” to participate in your event.

Give them the basics. Federbush said the part of his presentation that seemed to resonate most with the Lippman Connects Exhibitor Roundtable group is a basic checklist of information organizers should make easily available for potential exhibitors. “We hear from organizers that they want potential sponsors or exhibitors to contact them for information, but the exhibitor and sponsor doesn’t want to contact you for that information,” he said. “That’s basic stuff. They want to use that information to then decide if they want to contact you for more information. All of this should be ideally on the website — an exhibitor prospectus. Some companies are doing an amazing job with this and with sharing attendee information with exhibitors, and sponsors and potential ones, but many don’t. And I think it’s not because they’re hiding it or they’re ashamed of it. They just haven’t been asked. It’s that simple.”

Michelle Russell is editor in chief of Convene.